Institutional-Grade DeFi: A Shift Towards On-Chain Asset Management

Download Report Now

What will you learn?

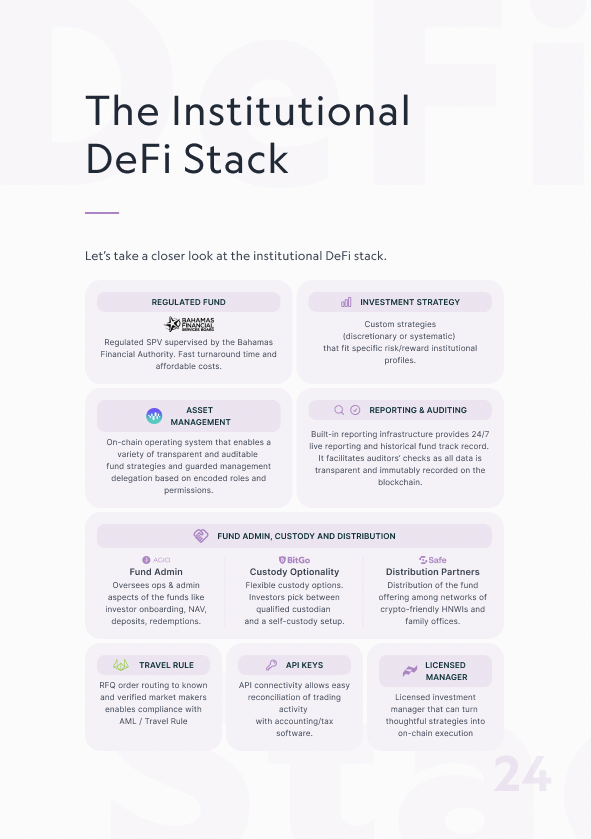

In this report, we present a solution that enables institutional investors to launch fully regulated and compliant DeFi funds. With our turnkey solution, you can retain all the benefits of DeFi while ensuring institutional-grade compliance.

This combination of technology has the potential to reduce the total expense ratios of funds by 80% and increase speed to market by 10x.

We take an in-depth look at:

| Why 78% of institutional investors agree the collapse of CeFi entities has made them more likely to use DeFi | |

| The innovations of on-chain asset management, including self-custody, elimination of counterparty risk and 24/7 transparency + reporting | |

|

How to use our institutional-grade DeFi stack to compliantly access on-chain investment opportunities |

Transform Your Business

Learn how to take advantage of the operational and administrative innovations that on-chain investing brings.

Reduce Costs by 80%

Our asset management solutions reduce operational costs and automate administrative functions so you can save 80% on fund expenses.

-1.jpg?width=200&height=200&name=Temp-200x200%20(1)-1.jpg)

10x Speed to Market

Speed up the fund creation process and launch a fully regulated DeFi fund in only 4 weeks (compared to 40 weeks in traditional financial services).

24/7 NAV Reporting

With live data pipelines from reliable on-chain sources, you can access 24/7 NAV reporting and generate real-time and historical reports.

-1.png?width=500&height=127&name=AVG_horiz_black%20(1)-1.png)